Allergen Microarray Diagnostics in 2025: Transforming Allergy Detection with High-Throughput Precision. Explore Market Growth, Breakthrough Technologies, and the Future of Personalized Allergy Care.

- Executive Summary: Key Trends and Market Drivers in 2025

- Market Size and Forecast (2025–2030): Growth Projections and CAGR Analysis

- Technological Innovations: Advances in Allergen Microarray Platforms

- Competitive Landscape: Leading Companies and Strategic Initiatives

- Regulatory Environment and Quality Standards

- Clinical Applications: Expanding Use Cases in Allergy Diagnostics

- Integration with Digital Health and Data Analytics

- Regional Analysis: North America, Europe, Asia-Pacific, and Emerging Markets

- Challenges and Barriers to Adoption

- Future Outlook: Opportunities, Disruptive Trends, and Strategic Recommendations

- Sources & References

Executive Summary: Key Trends and Market Drivers in 2025

The allergen microarray diagnostics sector is poised for significant growth and innovation in 2025, driven by rising allergy prevalence, demand for precision medicine, and technological advancements. Allergen microarrays, which enable simultaneous detection of specific IgE antibodies to hundreds of allergenic components, are increasingly recognized as transformative tools in allergy diagnosis and management. The shift from traditional singleplex assays to multiplexed microarray platforms is accelerating, as clinicians and laboratories seek comprehensive, efficient, and patient-tailored diagnostic solutions.

A key trend in 2025 is the expanding clinical adoption of component-resolved diagnostics (CRD) using microarrays. These platforms, such as the ImmunoCAP ISAC from Thermo Fisher Scientific, allow for detailed profiling of patient sensitization patterns, supporting more accurate risk assessment and personalized treatment strategies. The ability to distinguish between genuine sensitization and cross-reactivity is particularly valuable in complex cases, such as polysensitized individuals or those with food allergies. The integration of microarray data into digital health records and clinical decision support systems is also gaining momentum, enhancing workflow efficiency and patient outcomes.

Regulatory and reimbursement landscapes are evolving to accommodate these innovations. In 2025, several countries in Europe and Asia are updating guidelines to include microarray-based CRD as part of standard allergy workups, reflecting growing confidence in the clinical utility and cost-effectiveness of these technologies. The U.S. market, while more cautious, is seeing increased interest from academic centers and specialty clinics, with ongoing efforts to secure broader insurance coverage and FDA clearances for new platforms.

Major industry players are investing in R&D to expand allergen panels, improve assay sensitivity, and automate data interpretation. Thermo Fisher Scientific remains a global leader, leveraging its extensive allergen library and established laboratory networks. Bio-Rad Laboratories is also active in multiplex immunoassay development, while Siemens Healthineers and Danaher Corporation (through subsidiaries) are exploring integration of microarray diagnostics into broader clinical platforms. Emerging companies in Europe and Asia are contributing novel microarray formats and region-specific allergen content, reflecting the globalization of allergy diagnostics.

Looking ahead, the outlook for allergen microarray diagnostics is robust. Market drivers include the increasing burden of allergic diseases, the push for precision medicine, and the need for efficient, high-throughput laboratory solutions. Continued collaboration between industry, clinical researchers, and regulatory bodies will be essential to realize the full potential of microarray-based allergy diagnostics in the coming years.

Market Size and Forecast (2025–2030): Growth Projections and CAGR Analysis

The global market for allergen microarray diagnostics is poised for robust growth from 2025 through 2030, driven by increasing prevalence of allergic diseases, advances in multiplex diagnostic technologies, and a growing emphasis on personalized medicine. Allergen microarray platforms, which enable simultaneous detection of specific IgE antibodies to a wide range of allergenic proteins, are increasingly being adopted in clinical and research settings for their efficiency and comprehensive profiling capabilities.

In 2025, the allergen microarray diagnostics market is expected to reach a valuation in the mid-hundreds of millions USD, with projections indicating a compound annual growth rate (CAGR) between 8% and 12% through 2030. This growth is underpinned by rising demand for precise allergy diagnostics, particularly in North America and Europe, where awareness and healthcare infrastructure support advanced testing modalities. The Asia-Pacific region is anticipated to exhibit the fastest CAGR, attributed to expanding healthcare access, urbanization, and increasing incidence of allergic disorders.

Key industry players are investing in expanding their product portfolios and geographic reach. Thermo Fisher Scientific, through its ImmunoCAP ISAC platform, remains a global leader, offering a multiplexed allergen microarray that is widely used in both clinical and research laboratories. Bio-Rad Laboratories is also active in the immunodiagnostics space, providing solutions that complement microarray-based allergy testing. European companies such as MacroArray Diagnostics (Austria) are gaining traction with their multiplex allergy test systems, which are CE-marked and increasingly adopted in hospital laboratories across the continent.

The market outlook is further strengthened by ongoing innovation in microarray substrate materials, detection chemistries, and data analysis software, which are improving test sensitivity, specificity, and throughput. Regulatory approvals and inclusion in clinical guidelines are expected to accelerate adoption, particularly as health systems seek cost-effective, comprehensive allergy diagnostics. The integration of allergen microarray data into electronic health records and decision-support tools is anticipated to enhance clinical utility and patient management.

Looking ahead, the allergen microarray diagnostics market is set to benefit from continued R&D investment, strategic collaborations, and the expansion of direct-to-consumer testing models. As the burden of allergic diseases rises globally, the demand for high-throughput, multiplexed diagnostic solutions is expected to sustain double-digit growth rates through 2030, positioning allergen microarray diagnostics as a cornerstone of modern allergy care.

Technological Innovations: Advances in Allergen Microarray Platforms

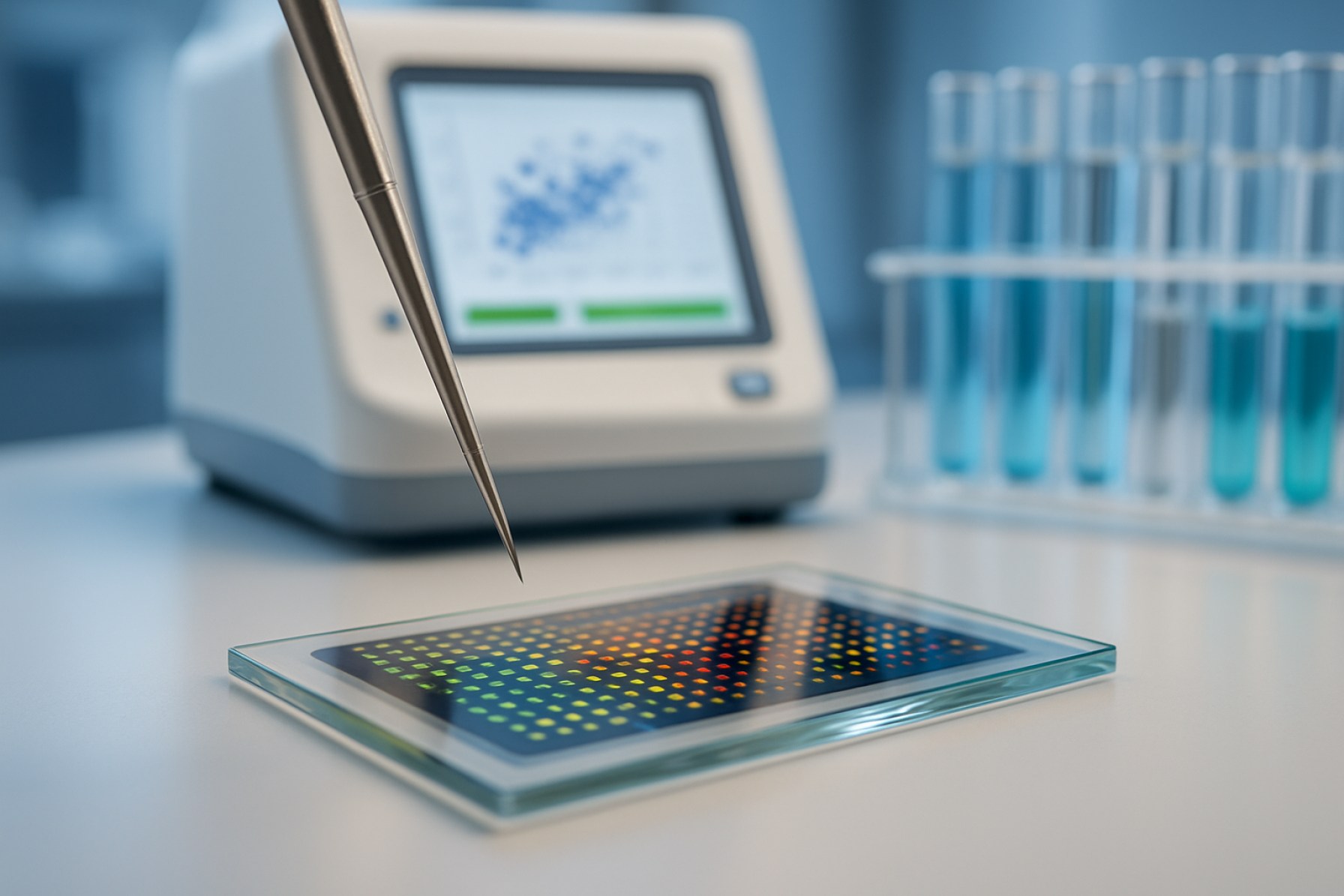

The field of allergen microarray diagnostics is experiencing significant technological innovation as we enter 2025, driven by the need for more precise, multiplexed, and patient-tailored allergy profiling. Allergen microarrays, which allow simultaneous detection of specific IgE antibodies against hundreds of allergenic proteins, are increasingly being adopted in clinical and research settings for their efficiency and comprehensive data output.

One of the most prominent platforms in this space is the ImmunoCAP ISAC, developed by Thermo Fisher Scientific. This microarray enables the detection of IgE antibodies to over 100 allergen components in a single assay, using only a small serum sample. In 2025, Thermo Fisher Scientific continues to refine the ISAC platform, focusing on improved sensitivity, expanded allergen panels, and enhanced software for data interpretation. The company is also working on integrating artificial intelligence (AI) algorithms to assist clinicians in interpreting complex sensitization patterns, a move expected to streamline diagnosis and support personalized allergy management.

Another key player, MacroArray Diagnostics, offers the ALEX (Allergy Explorer) platform, which has gained traction in Europe and other regions. The ALEX2 test, launched in recent years, can simultaneously analyze IgE reactivity to more than 280 allergen extracts and molecular components. In 2025, MacroArray Diagnostics is focusing on further automation, reducing assay turnaround times, and expanding the test menu to include emerging allergens relevant to changing environmental and dietary patterns.

Technological advances are also being driven by miniaturization and integration with digital health tools. Companies are developing next-generation microarrays with higher spot densities, improved surface chemistries for greater specificity, and compatibility with smaller sample volumes—making them suitable for pediatric and point-of-care applications. The integration of cloud-based data management and telemedicine platforms is expected to facilitate remote allergy diagnostics and longitudinal patient monitoring.

Looking ahead, the outlook for allergen microarray diagnostics is marked by ongoing innovation in assay design, data analytics, and clinical utility. Industry leaders are collaborating with academic and clinical partners to validate new biomarkers, standardize result interpretation, and support regulatory approvals in additional markets. As a result, allergen microarrays are poised to become a cornerstone of precision allergy diagnostics, enabling earlier intervention and more effective management of allergic diseases in the coming years.

Competitive Landscape: Leading Companies and Strategic Initiatives

The competitive landscape of allergen microarray diagnostics in 2025 is characterized by a small number of specialized companies with strong technological portfolios, ongoing product innovation, and strategic partnerships. The sector is driven by the increasing demand for multiplex allergy testing, which enables simultaneous detection of specific IgE antibodies to a wide range of allergens using minimal patient sample volumes. This approach is particularly valuable in complex allergy cases and for pediatric populations.

A key player in this field is Thermo Fisher Scientific, whose ImmunoCAP ISAC (Immuno Solid-phase Allergen Chip) platform remains one of the most widely adopted allergen microarray systems globally. The ISAC test allows for the semi-quantitative measurement of IgE antibodies against more than 100 allergen components in a single assay. Thermo Fisher continues to invest in expanding its allergen panel and improving assay sensitivity, while also supporting clinical research collaborations to validate the clinical utility of component-resolved diagnostics.

Another significant company is MacroArray Diagnostics, based in Austria, which offers the ALEX (Allergy Explorer) and ALEX2 platforms. These systems provide broad allergen coverage, including both whole extracts and molecular components, and are designed for high-throughput laboratory environments. MacroArray Diagnostics has focused on expanding its international distribution network and securing regulatory approvals in new markets, particularly in Europe and Asia. The company also emphasizes the integration of digital data management and interpretation tools to support clinicians in making informed diagnostic decisions.

Emerging competitors are also entering the market, leveraging advances in microarray fabrication, bioinformatics, and automation. For example, Hycult Biotech and ZenTech are developing multiplex immunoassay platforms that may be adapted for allergen profiling, although their current focus is broader and includes other biomarker panels. These companies are expected to play a more prominent role as the technology matures and as demand for personalized allergy diagnostics grows.

Strategic initiatives in the sector include collaborations with academic research centers to validate new allergen components, partnerships with reference laboratories to expand test access, and investments in digital health solutions for data integration. Regulatory compliance, particularly with evolving European Union In Vitro Diagnostic Regulation (IVDR) requirements, remains a priority for all market participants.

Looking ahead, the competitive landscape is likely to see further consolidation, with established players strengthening their portfolios through acquisitions and technology licensing. The continued expansion of allergen panels, improvements in assay automation, and integration with electronic health records are expected to drive adoption and shape the market over the next few years.

Regulatory Environment and Quality Standards

The regulatory environment for allergen microarray diagnostics is evolving rapidly as these technologies become increasingly integral to allergy diagnosis and management. In 2025, regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) continue to refine their frameworks to address the unique challenges posed by multiplexed in vitro diagnostic (IVD) devices. Allergen microarrays, which can simultaneously detect IgE reactivity to dozens or hundreds of allergenic components, require rigorous validation to ensure analytical accuracy, clinical relevance, and reproducibility.

In the United States, allergen microarray diagnostics are regulated as Class II or Class III medical devices, depending on their intended use and risk profile. Manufacturers must comply with the FDA’s Quality System Regulation (QSR) under 21 CFR Part 820, which mandates comprehensive quality management systems, including design controls, risk management, and post-market surveillance. The FDA has also issued guidance on multiplex tests, emphasizing the need for robust analytical validation and clear clinical performance data. As of 2025, the FDA is increasingly encouraging the use of real-world evidence and post-market data to support ongoing safety and effectiveness assessments.

In the European Union, the regulatory landscape has shifted significantly with the full implementation of the In Vitro Diagnostic Regulation (IVDR) (EU 2017/746), which became fully applicable in May 2022. The IVDR imposes stricter requirements for clinical evidence, performance evaluation, and post-market surveillance compared to the previous In Vitro Diagnostic Directive (IVDD). Allergen microarray products are now classified according to a risk-based system, with most falling into Class C, requiring notified body involvement for conformity assessment. Manufacturers such as Thermo Fisher Scientific—the producer of the ImmunoCAP ISAC microarray—have had to update their technical documentation, clinical evidence, and quality management systems to maintain CE marking under the new regulation.

Internationally, harmonization efforts are ongoing through organizations like the International Organization for Standardization (ISO), with ISO 13485:2016 remaining the global benchmark for quality management systems in medical device manufacturing. Compliance with ISO 15189 for medical laboratories is also increasingly expected, ensuring the reliability and traceability of diagnostic results.

Looking ahead, regulatory agencies are expected to further clarify requirements for next-generation allergen microarrays, particularly as new biomarkers and digital health integrations emerge. The trend toward personalized medicine and the use of big data in allergy diagnostics will likely prompt additional guidance on data security, interoperability, and clinical decision support. Industry leaders such as Thermo Fisher Scientific and MacroArray Diagnostics are actively engaging with regulators and standardization bodies to shape future quality and safety standards, ensuring that allergen microarray diagnostics remain both innovative and trustworthy in clinical practice.

Clinical Applications: Expanding Use Cases in Allergy Diagnostics

Allergen microarray diagnostics are rapidly transforming clinical allergy testing by enabling simultaneous detection of specific IgE antibodies against a broad spectrum of allergenic molecules. As of 2025, these multiplex platforms are increasingly integrated into routine clinical practice, particularly in Europe and parts of Asia, with growing adoption in North America. The technology’s ability to provide component-resolved diagnostics (CRD) is driving its use beyond traditional single-allergen tests, supporting more precise diagnosis, risk stratification, and personalized management of allergic diseases.

The most widely used allergen microarray system is the ImmunoCAP ISAC, developed by Thermo Fisher Scientific. This platform can simultaneously analyze patient sera for IgE reactivity to over 100 allergen components, covering food, inhalant, and venom allergens. In 2024–2025, Thermo Fisher Scientific has reported increased clinical uptake, particularly in tertiary allergy centers and specialized clinics, where the technology is used to clarify complex sensitization patterns, such as distinguishing genuine peanut allergy from cross-reactivity due to birch pollen sensitization.

Another notable player is MacroArray Diagnostics, an Austrian company offering the ALEX (Allergy Explorer) platform. ALEX and its successor, ALEX2, provide quantitative IgE results for over 280 allergen extracts and molecular components, making it one of the most comprehensive panels available. As of 2025, MacroArray Diagnostics has expanded its distribution network across Europe, the Middle East, and Asia, and is actively pursuing regulatory approvals in North America. The company emphasizes the clinical value of its multiplex approach in poly-sensitized patients and in pediatric allergy workups.

Clinical applications are broadening. Allergen microarrays are now routinely used for:

- Identifying primary sensitizers versus cross-reactive allergens, crucial for food allergy management and immunotherapy decisions.

- Risk assessment in anaphylaxis, such as distinguishing between high-risk peanut or nut allergies and less severe cross-reactions.

- Guiding selection and monitoring of allergen-specific immunotherapy, especially in polysensitized individuals.

- Supporting epidemiological studies and biomarker discovery in allergy research.

Looking ahead, the next few years are expected to see further expansion of clinical indications, including integration with digital health records and decision-support tools. Both Thermo Fisher Scientific and MacroArray Diagnostics are investing in automation, data analytics, and user-friendly reporting to facilitate broader adoption in community and primary care settings. As regulatory frameworks evolve and reimbursement policies adapt, allergen microarray diagnostics are poised to become a cornerstone of precision allergy medicine worldwide.

Integration with Digital Health and Data Analytics

The integration of allergen microarray diagnostics with digital health platforms and advanced data analytics is rapidly transforming allergy diagnosis and management as of 2025. Allergen microarrays, such as those developed by Thermo Fisher Scientific and MacroArray Diagnostics, enable simultaneous detection of specific IgE antibodies to hundreds of allergenic components from a single patient sample. This multiplexing capability generates complex datasets, which are increasingly being leveraged through digital health solutions and artificial intelligence (AI)-driven analytics.

Recent years have seen the emergence of cloud-based platforms that facilitate secure storage, sharing, and interpretation of microarray results. For example, Thermo Fisher Scientific offers digital tools that integrate ImmunoCAP ISAC microarray data with electronic health records (EHRs), supporting clinicians in making data-driven decisions. Similarly, MacroArray Diagnostics provides the ALEX2 platform, which includes digital reporting and compatibility with laboratory information systems (LIS), streamlining workflow and enabling remote access for healthcare providers.

AI and machine learning algorithms are increasingly applied to interpret the high-dimensional data generated by allergen microarrays. These tools can identify sensitization patterns, predict clinical relevance, and even suggest personalized management strategies. In 2025, collaborations between diagnostic companies and digital health firms are accelerating, with a focus on developing decision support systems that integrate microarray data with patient history, environmental exposure, and real-world outcomes. This trend is exemplified by partnerships between device manufacturers and digital health startups, aiming to create comprehensive allergy management ecosystems.

Patient-facing digital applications are also gaining traction. Mobile apps and web portals now allow patients to access their microarray results, track symptoms, and receive tailored educational content. This empowers patients to participate actively in their care and facilitates remote monitoring by clinicians. The integration of microarray diagnostics with telemedicine platforms is particularly relevant in the context of ongoing global health challenges, enabling continuity of care and expanding access to specialist expertise.

Looking ahead, the next few years are expected to bring further advances in interoperability standards, data privacy, and regulatory frameworks, supporting broader adoption of integrated digital-microarray solutions. Industry leaders such as Thermo Fisher Scientific and MacroArray Diagnostics are likely to continue driving innovation, with a focus on real-time analytics, predictive modeling, and seamless integration with broader digital health infrastructures.

Regional Analysis: North America, Europe, Asia-Pacific, and Emerging Markets

The global landscape for allergen microarray diagnostics is evolving rapidly, with significant regional differences in adoption, regulatory frameworks, and market drivers. As of 2025, North America, Europe, Asia-Pacific, and emerging markets each present unique opportunities and challenges for the deployment and growth of these advanced diagnostic platforms.

- North America: The United States and Canada remain at the forefront of allergen microarray diagnostics, driven by high prevalence of allergic diseases, advanced healthcare infrastructure, and strong presence of leading manufacturers. Companies such as Thermo Fisher Scientific (with its ImmunoCAP ISAC platform) and Bio-Rad Laboratories are key players, benefiting from robust clinical adoption and ongoing research collaborations with academic centers. Regulatory clarity from the U.S. Food and Drug Administration (FDA) and Health Canada supports market growth, while reimbursement policies are gradually expanding to cover multiplex allergy testing. The region is also witnessing increased integration of microarray diagnostics into personalized medicine initiatives.

- Europe: Europe has been a pioneer in allergen microarray diagnostics, with early adoption in countries such as Germany, Spain, and the Nordic nations. The region benefits from harmonized regulatory pathways under the In Vitro Diagnostic Regulation (IVDR), which is shaping product development and market entry strategies. Thermo Fisher Scientific maintains a strong presence, and companies like Macro Array Diagnostics (Austria) are expanding their offerings, such as the ALEX2 platform, which covers a broad spectrum of allergen components. European clinical guidelines increasingly recommend component-resolved diagnostics, further driving adoption. However, reimbursement remains variable across countries, influencing the pace of market penetration.

- Asia-Pacific: The Asia-Pacific region is experiencing accelerated growth, fueled by rising allergy prevalence, urbanization, and increasing healthcare expenditure. Japan, South Korea, and Australia are leading in clinical adoption, while China and India are emerging as high-potential markets due to large patient populations and expanding laboratory infrastructure. Local partnerships and technology transfer agreements are becoming more common, with global companies such as Thermo Fisher Scientific and Bio-Rad Laboratories actively expanding their regional footprint. Regulatory processes are being streamlined, but market access can be complex due to diverse healthcare systems and varying levels of clinician awareness.

- Emerging Markets: In Latin America, the Middle East, and Africa, allergen microarray diagnostics are at an earlier stage of adoption. Growth is primarily driven by increasing awareness of allergic diseases and gradual improvements in healthcare infrastructure. International organizations and manufacturers are engaging in educational initiatives and pilot projects to demonstrate clinical utility. However, challenges such as limited reimbursement, high upfront costs, and lack of trained personnel continue to restrict widespread adoption. Over the next few years, targeted investments and public-private partnerships are expected to play a crucial role in expanding access.

Looking ahead, the global market for allergen microarray diagnostics is poised for steady expansion, with regional dynamics shaped by regulatory evolution, reimbursement policies, and ongoing innovation from established and emerging companies. Strategic collaborations and localization efforts will be key to unlocking growth, particularly in Asia-Pacific and emerging markets.

Challenges and Barriers to Adoption

Allergen microarray diagnostics, which enable multiplexed detection of specific IgE antibodies to a wide range of allergenic proteins, have gained traction in clinical allergy testing. However, several challenges and barriers continue to limit their widespread adoption as of 2025 and are likely to persist in the near future.

One of the primary challenges is the cost and reimbursement landscape. Allergen microarray platforms, such as the ImmunoCAP ISAC from Thermo Fisher Scientific and the ALEX2 test from MacroArray Diagnostics, require significant investment in both instrumentation and consumables. The per-test cost remains higher than traditional singleplex assays, and reimbursement policies vary widely by country and insurer. This financial barrier can limit access, especially in regions with constrained healthcare budgets or where allergy diagnostics are not prioritized.

Another significant barrier is the need for specialized interpretation. Microarray results provide a complex profile of sensitizations, often including clinically irrelevant or cross-reactive components. This complexity demands a high level of expertise for accurate interpretation, which is not universally available among clinicians. Training programs and standardized guidelines are still evolving, and the lack of consensus on how to integrate microarray data into clinical decision-making can hinder adoption.

Regulatory and standardization issues also pose challenges. While leading platforms from Thermo Fisher Scientific and MacroArray Diagnostics have achieved CE marking for use in Europe, regulatory approval in other major markets, such as the United States, remains limited. The absence of harmonized international standards for allergen components and assay performance further complicates cross-border adoption and comparison of results.

From a technical perspective, microarray diagnostics face limitations in sensitivity for certain allergens, particularly those present at low concentrations or with low IgE affinity. Additionally, the panels are constrained by the selection of allergen components included, which may not cover regionally relevant or emerging allergens. Companies like MacroArray Diagnostics are actively expanding their panels, but keeping pace with the evolving landscape of allergen exposure remains a challenge.

Finally, integration into clinical workflows is not seamless. Many healthcare systems are structured around traditional allergy testing paradigms, and the adoption of microarray diagnostics often requires changes in laboratory processes, electronic health record integration, and patient counseling protocols.

Looking ahead, overcoming these barriers will require coordinated efforts among manufacturers, regulatory bodies, and clinical societies. Advances in automation, cost reduction, and education, as well as broader regulatory approvals, are anticipated to gradually improve adoption rates over the next few years.

Future Outlook: Opportunities, Disruptive Trends, and Strategic Recommendations

The future of allergen microarray diagnostics is poised for significant transformation as the field leverages advances in molecular biology, digital health, and personalized medicine. In 2025 and the coming years, several disruptive trends and opportunities are expected to shape the sector, with strategic implications for manufacturers, clinicians, and healthcare systems.

A key driver is the increasing demand for precise, component-resolved allergy diagnostics. Allergen microarrays, such as those pioneered by Thermo Fisher Scientific (notably the ImmunoCAP ISAC platform), enable simultaneous detection of IgE antibodies against dozens to hundreds of allergen components from a single patient sample. This multiplexing capability is becoming essential as clinicians seek to differentiate between genuine sensitization and cross-reactivity, especially in complex cases involving food, pollen, and animal allergens. The trend is reinforced by growing awareness of the limitations of traditional extract-based tests and the need for more granular risk assessment in allergy management.

Technological innovation is accelerating. Companies such as Thermo Fisher Scientific and Macro Array Diagnostics are investing in next-generation microarray platforms with improved sensitivity, broader allergen panels, and integration with digital data management tools. For example, Macro Array Diagnostics’ ALEX2 platform offers quantitative results for over 280 allergen extracts and molecular components, supporting both clinical diagnostics and research applications. The integration of artificial intelligence and machine learning for automated interpretation of complex microarray data is also on the horizon, promising to reduce diagnostic errors and streamline clinical workflows.

Regulatory and reimbursement landscapes are evolving in parallel. The European Union’s In Vitro Diagnostic Regulation (IVDR) is prompting manufacturers to enhance the analytical and clinical validation of their microarray products, which may raise barriers to entry but also improve overall test quality. In the United States and other major markets, efforts to secure broader insurance coverage for advanced allergy diagnostics are ongoing, with positive outcomes likely to accelerate adoption.

Strategically, companies are advised to focus on expanding their allergen panels to include region-specific and emerging allergens, invest in digital connectivity for seamless integration with electronic health records, and pursue partnerships with academic and clinical research centers to validate clinical utility. There is also a growing opportunity in direct-to-consumer and telehealth-enabled allergy testing, provided regulatory requirements are met.

In summary, allergen microarray diagnostics are set for robust growth and innovation through 2025 and beyond, driven by clinical demand for precision, technological advances, and evolving regulatory frameworks. Market leaders such as Thermo Fisher Scientific and Macro Array Diagnostics are well positioned, but the landscape remains dynamic, with opportunities for new entrants and disruptive business models.