Conformal Flexible Electronics Manufacturing in 2025: How Adaptive Technologies Are Reshaping Wearables, IoT, and Beyond. Discover the Market Forces and Breakthroughs Driving an 18% Surge Through 2030.

- Executive Summary: Key Findings & 2025 Outlook

- Market Size, Share & 2025–2030 Growth Forecast (18% CAGR)

- Technology Landscape: Materials, Processes, and Integration

- Key Applications: Wearables, Medical Devices, Automotive, and IoT

- Competitive Analysis: Leading Players and Emerging Innovators

- Supply Chain & Manufacturing Trends

- Regulatory Environment and Standards

- Investment, M&A, and Funding Activity

- Challenges, Risks, and Barriers to Adoption

- Future Outlook: Disruptive Innovations and Market Opportunities to 2030

- Sources & References

Executive Summary: Key Findings & 2025 Outlook

Conformal flexible electronics manufacturing is rapidly transforming the landscape of electronic device design and integration, enabling electronics to be seamlessly embedded onto curved, irregular, or dynamic surfaces. In 2025, the sector is poised for significant growth, driven by advances in materials science, scalable manufacturing processes, and expanding end-use applications across healthcare, automotive, consumer electronics, and industrial sectors.

Key findings indicate that the adoption of advanced substrates—such as stretchable polymers and ultra-thin films—has improved device reliability and mechanical resilience, allowing for more robust and durable flexible electronics. Innovations in additive manufacturing, including inkjet and screen printing of conductive inks, have enabled high-throughput, cost-effective production while maintaining fine feature resolution. Leading industry players, such as DuPont and Konica Minolta, Inc., have introduced new materials and process solutions that support large-area, roll-to-roll fabrication, further reducing production costs and enabling mass-market adoption.

The healthcare sector remains a primary driver, with conformal flexible electronics powering next-generation wearable sensors, smart patches, and implantable devices. Regulatory approvals and partnerships with medical device manufacturers are accelerating commercialization. In automotive and aerospace, flexible electronics are being integrated into interior surfaces, lighting, and structural health monitoring systems, with companies like Robert Bosch GmbH investing in R&D for in-vehicle applications.

Looking ahead to 2025, the outlook for conformal flexible electronics manufacturing is robust. Market analysts anticipate double-digit annual growth, underpinned by continued investment in R&D, the emergence of new application areas, and the maturation of supply chains. Key challenges remain, including the need for standardized testing protocols, improved long-term reliability, and scalable encapsulation techniques to protect devices in harsh environments. However, ongoing collaboration between material suppliers, equipment manufacturers, and end-users is expected to address these hurdles.

In summary, 2025 will see conformal flexible electronics manufacturing move from niche applications toward mainstream adoption, with technological advancements and cross-industry partnerships driving innovation and market expansion.

Market Size, Share & 2025–2030 Growth Forecast (18% CAGR)

The global conformal flexible electronics manufacturing market is poised for robust expansion, with projections indicating an impressive compound annual growth rate (CAGR) of approximately 18% from 2025 to 2030. This growth trajectory is driven by escalating demand for lightweight, bendable, and stretchable electronic components across diverse sectors, including consumer electronics, healthcare, automotive, and industrial applications.

In 2025, the market is estimated to reach a valuation of around USD 6.2 billion, with Asia-Pacific maintaining its dominance due to the presence of major manufacturing hubs and a strong supply chain ecosystem. Countries such as South Korea, Japan, and China are at the forefront, supported by significant investments in research and development from industry leaders like Samsung Electronics Co., Ltd. and LG Electronics Inc.. North America and Europe are also witnessing accelerated adoption, particularly in medical devices and automotive electronics, with companies such as DuPont de Nemours, Inc. and 3M Company playing pivotal roles in material innovation and process development.

The market share is expected to be distributed among key application segments, with wearable devices and flexible displays accounting for the largest portion. The healthcare sector is anticipated to register the fastest growth, propelled by the integration of conformal electronics in biosensors, smart patches, and implantable devices. Automotive applications, including conformal lighting and in-cabin sensors, are also projected to contribute significantly to market expansion, as OEMs like Robert Bosch GmbH and Continental AG invest in next-generation vehicle electronics.

Looking ahead to 2030, the market is forecasted to surpass USD 14 billion, underpinned by advancements in printing technologies, material science, and scalable manufacturing processes. Strategic collaborations between electronics manufacturers, material suppliers, and research institutions are expected to accelerate commercialization and reduce production costs. Regulatory support and standardization efforts by organizations such as the Institute of Electrical and Electronics Engineers (IEEE) will further facilitate market growth and adoption.

Technology Landscape: Materials, Processes, and Integration

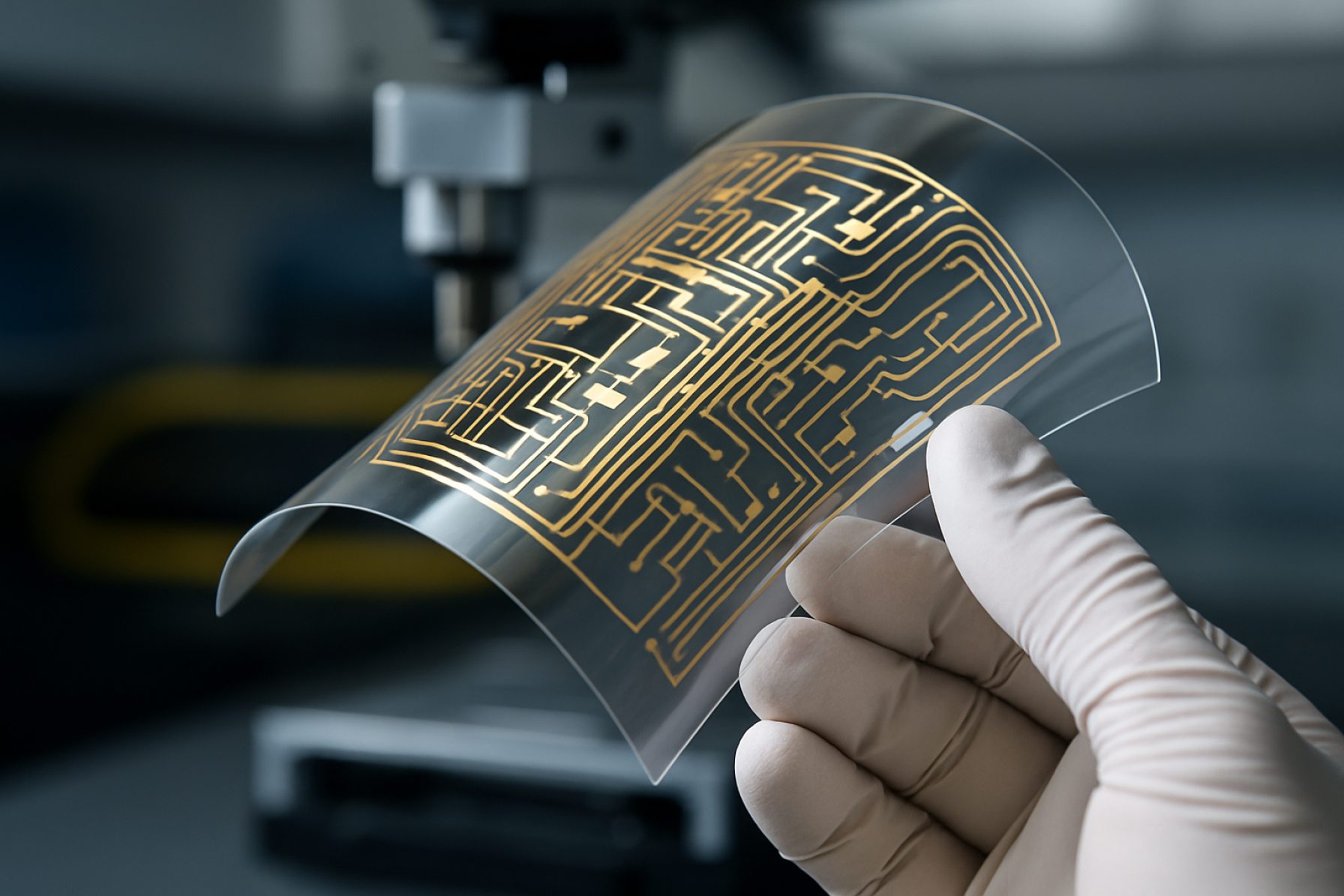

The technology landscape for conformal flexible electronics manufacturing in 2025 is characterized by rapid advancements in materials science, innovative fabrication processes, and sophisticated integration strategies. Conformal flexible electronics are designed to seamlessly adapt to non-planar surfaces, enabling applications in wearables, biomedical devices, automotive interiors, and smart packaging. The evolution of this field is driven by the development of novel materials, such as stretchable conductors, flexible substrates, and advanced encapsulants, which collectively enhance device performance and durability.

Key materials include organic semiconductors, conductive polymers, and nanomaterial-based inks (e.g., silver nanowires, graphene), which offer both electrical functionality and mechanical flexibility. Substrates such as polyimide, polyethylene terephthalate (PET), and thermoplastic polyurethane (TPU) are widely used due to their flexibility, thermal stability, and compatibility with roll-to-roll processing. Recent innovations have also introduced biodegradable and biocompatible substrates, expanding the potential for medical and environmentally friendly applications.

Manufacturing processes have evolved to accommodate the unique requirements of conformal electronics. Techniques such as inkjet printing, screen printing, and aerosol jet printing enable precise deposition of functional materials onto flexible substrates, supporting high-throughput and cost-effective production. Roll-to-roll (R2R) processing, in particular, has emerged as a cornerstone for scalable manufacturing, allowing continuous fabrication of electronic circuits on large-area flexible films. Laser patterning and photolithography are also adapted for flexible formats, providing fine feature resolution essential for advanced device architectures.

Integration strategies focus on the seamless assembly of electronic components onto flexible and stretchable platforms. This includes the development of flexible interconnects, stretchable batteries, and thin-film encapsulation techniques to protect devices from environmental stressors. Hybrid integration, combining rigid and flexible components, is increasingly common, enabling complex functionalities while maintaining mechanical compliance. Advanced packaging solutions, such as conformal coatings and 3D encapsulation, further enhance device reliability and longevity.

Industry leaders and research institutions, including imec, FlexEnable Limited, and DuPont, are at the forefront of developing and commercializing these technologies. Collaborative efforts between material suppliers, equipment manufacturers, and end-users are accelerating the transition from laboratory-scale prototypes to mass-market products, shaping the future of conformal flexible electronics manufacturing.

Key Applications: Wearables, Medical Devices, Automotive, and IoT

Conformal flexible electronics manufacturing is enabling a new generation of devices that seamlessly integrate with complex surfaces and dynamic environments. This section explores the key application domains—wearables, medical devices, automotive, and the Internet of Things (IoT)—where conformal flexible electronics are driving innovation in 2025.

- Wearables: The wearables sector continues to benefit from conformal flexible electronics, which allow sensors, displays, and circuits to be embedded into textiles and curved surfaces. This technology supports the development of smart clothing, fitness trackers, and health-monitoring patches that are lightweight, stretchable, and comfortable for continuous use. Companies like Samsung Electronics Co., Ltd. and Apple Inc. are integrating flexible components into their next-generation wearable devices, enhancing user experience and device durability.

- Medical Devices: In healthcare, conformal flexible electronics are revolutionizing patient monitoring and diagnostics. Flexible biosensors and electronic skin patches can conform to the human body, providing real-time data on vital signs, wound healing, and drug delivery. Organizations such as Medtronic plc and Koninklijke Philips N.V. are advancing the use of flexible electronics in medical implants and remote monitoring solutions, improving patient outcomes and comfort.

- Automotive: The automotive industry is leveraging conformal flexible electronics for both interior and exterior applications. Flexible touch panels, lighting systems, and sensor arrays can be integrated into curved dashboards, seats, and even vehicle exteriors. This enhances design freedom, safety, and user interaction. Automakers such as Bayerische Motoren Werke AG (BMW Group) and Toyota Motor Corporation are exploring these technologies to create more intuitive and adaptive vehicle environments.

- IoT (Internet of Things): The proliferation of IoT devices is fueled by the adaptability of conformal flexible electronics, which can be embedded in a wide range of objects and environments. Flexible sensors and circuits enable smart packaging, environmental monitoring, and asset tracking, even on irregular or moving surfaces. Industry leaders like STMicroelectronics N.V. and Texas Instruments Incorporated are developing flexible platforms to support the expanding IoT ecosystem.

In 2025, the convergence of conformal flexible electronics with these key sectors is accelerating the creation of smarter, more integrated, and user-centric products, underscoring the transformative potential of this manufacturing approach.

Competitive Analysis: Leading Players and Emerging Innovators

The competitive landscape of conformal flexible electronics manufacturing in 2025 is characterized by a dynamic interplay between established industry leaders and a wave of emerging innovators. Major players such as LG Display Co., Ltd., Samsung Display Co., Ltd., and DuPont continue to dominate the market with their robust R&D capabilities, extensive patent portfolios, and vertically integrated manufacturing processes. These companies leverage advanced materials science and scalable roll-to-roll production techniques to deliver high-performance, reliable flexible electronic components for applications ranging from wearable devices to automotive interiors.

In parallel, a cohort of agile startups and university spin-offs are driving innovation in niche segments. Companies like FlexEnable Limited and Palo Alto Research Center Incorporated (PARC) are pioneering organic transistor technologies and novel substrate materials, enabling new form factors and ultra-thin, lightweight devices. These innovators often collaborate with research institutions and leverage government grants to accelerate the commercialization of next-generation conformal electronics.

Strategic partnerships and joint ventures are increasingly common, as established manufacturers seek to integrate disruptive technologies developed by startups. For example, collaborations between Robert Bosch GmbH and flexible electronics specialists have resulted in advanced sensor arrays for smart surfaces and medical diagnostics. Meanwhile, material suppliers such as Kuraray Co., Ltd. and 3M are investing in conductive inks and flexible substrates, supporting the ecosystem with critical enabling technologies.

Geographically, Asia-Pacific remains the epicenter of large-scale manufacturing, with significant investments in production infrastructure and supply chain integration. However, North America and Europe are notable for their focus on high-value, customized solutions and early-stage R&D. The competitive environment is further shaped by evolving industry standards and regulatory frameworks, which incentivize both incremental improvements and breakthrough innovations.

Overall, the sector’s competitive dynamics in 2025 reflect a balance between the scale and reliability offered by established corporations and the agility and creativity of emerging innovators, collectively driving the rapid evolution of conformal flexible electronics manufacturing.

Supply Chain & Manufacturing Trends

The manufacturing landscape for conformal flexible electronics is rapidly evolving in 2025, driven by advances in materials science, process automation, and the growing demand for wearable and embedded devices. Conformal flexible electronics, which can bend, stretch, and adapt to complex surfaces, require specialized supply chains and manufacturing techniques distinct from traditional rigid electronics.

A key trend is the integration of advanced materials such as stretchable conductive inks, ultra-thin substrates, and hybrid organic-inorganic semiconductors. Companies like DuPont and 3M are at the forefront, supplying innovative materials that enable high-performance, durable, and biocompatible devices. These materials are essential for applications in healthcare, automotive interiors, and consumer electronics, where devices must conform to irregular shapes or human skin.

Manufacturing processes are shifting towards roll-to-roll (R2R) and additive manufacturing techniques, which allow for high-throughput, cost-effective production of flexible circuits. Kateeva and NovaCentrix are notable for their scalable printing and curing technologies, supporting the mass production of flexible displays, sensors, and antennas. These processes reduce waste and energy consumption compared to traditional subtractive methods, aligning with sustainability goals.

Supply chain strategies are also adapting to the unique requirements of conformal electronics. Manufacturers are increasingly forming partnerships with material suppliers and device integrators to ensure quality and traceability throughout the production cycle. Organizations like SEMI are facilitating industry standards and best practices, helping to streamline the integration of flexible electronics into existing supply chains.

Another significant trend is the localization of manufacturing, with companies establishing regional production hubs to reduce lead times and respond quickly to market demands. This is particularly relevant for sectors such as medical devices and automotive, where customization and rapid prototyping are critical. The adoption of digital twins and smart factory technologies, promoted by entities like Siemens AG, is further enhancing process control and product quality.

In summary, the supply chain and manufacturing of conformal flexible electronics in 2025 are characterized by material innovation, process automation, sustainability, and agile supply networks, positioning the sector for continued growth and diversification.

Regulatory Environment and Standards

The regulatory environment for conformal flexible electronics manufacturing in 2025 is shaped by evolving standards that address the unique challenges of producing electronics on non-traditional, often irregular surfaces. As these devices are increasingly integrated into medical, automotive, aerospace, and consumer applications, compliance with sector-specific regulations and international standards is critical for market access and safety assurance.

Key regulatory frameworks include the ISO/IEC 62341 series for organic light-emitting diode (OLED) displays, which is relevant for flexible display technologies, and the International Electrotechnical Commission (IEC) standards for electronic assemblies. For medical applications, manufacturers must adhere to the U.S. Food and Drug Administration (FDA) regulations and the European Union Medical Device Regulation (MDR), which require rigorous testing for biocompatibility, reliability, and safety of wearable and implantable devices.

Environmental and sustainability considerations are increasingly prominent. The Restriction of Hazardous Substances (RoHS) Directive and the U.S. Environmental Protection Agency (EPA) guidelines on electronic waste management influence material selection and end-of-life strategies for flexible electronics. Manufacturers must ensure that inks, substrates, and encapsulants used in conformal electronics comply with these directives to minimize environmental impact.

Industry consortia such as the SEMI and the IEEE are actively developing new standards and best practices tailored to the unique requirements of flexible and printed electronics, including test methods for mechanical durability, electrical performance under deformation, and long-term reliability. These standards are essential for interoperability, quality assurance, and fostering innovation in the sector.

In summary, the regulatory landscape for conformal flexible electronics manufacturing in 2025 is characterized by a convergence of established electronics standards, sector-specific regulations, and emerging guidelines that address the distinct properties and applications of flexible devices. Proactive engagement with regulatory bodies and standards organizations is essential for manufacturers to ensure compliance, facilitate global market entry, and drive technological advancement.

Investment, M&A, and Funding Activity

The landscape of investment, mergers and acquisitions (M&A), and funding activity in conformal flexible electronics manufacturing is expected to remain dynamic in 2025, reflecting the sector’s rapid technological evolution and expanding commercial applications. Conformal flexible electronics—devices that can bend, stretch, and conform to complex surfaces—are increasingly integral to industries such as healthcare, automotive, consumer electronics, and wearables. This broadening market appeal is attracting significant capital inflows from both strategic investors and venture capital firms.

Major electronics manufacturers and material suppliers are actively pursuing acquisitions and strategic partnerships to secure intellectual property, expand manufacturing capabilities, and accelerate time-to-market for next-generation products. For example, LG Electronics and Samsung Electronics have both increased their investments in flexible display and sensor technologies, often through joint ventures or minority stakes in innovative startups. These moves are designed to strengthen their positions in emerging markets such as foldable smartphones and smart textiles.

In the healthcare sector, companies like Medtronic and Philips are investing in flexible biosensors and wearable medical devices, frequently collaborating with specialized manufacturers to integrate conformal electronics into their product portfolios. Such partnerships often involve co-development agreements and equity investments, enabling established firms to leverage the agility and technical expertise of smaller innovators.

Venture capital activity remains robust, with early-stage funding rounds supporting startups focused on novel materials, scalable printing techniques, and advanced manufacturing processes. Organizations such as FlexEnable and imec have attracted funding to commercialize flexible transistor arrays and large-area sensor platforms, respectively. These investments are often accompanied by non-dilutive grants from government agencies and industry consortia, reflecting public sector interest in fostering domestic manufacturing capabilities and supply chain resilience.

Looking ahead to 2025, the convergence of strategic M&A, corporate venture capital, and public-private partnerships is expected to accelerate the commercialization of conformal flexible electronics. As the technology matures and production scales, further consolidation among material suppliers, device manufacturers, and system integrators is likely, shaping a more integrated and competitive global ecosystem.

Challenges, Risks, and Barriers to Adoption

The adoption of conformal flexible electronics manufacturing faces several significant challenges, risks, and barriers that must be addressed to enable widespread commercialization and integration into mainstream applications. One of the primary technical challenges is the development of reliable materials and processes that maintain electronic performance while withstanding repeated mechanical deformation, such as bending, stretching, and twisting. Traditional semiconductor materials and fabrication techniques are often incompatible with the mechanical requirements of flexible substrates, necessitating innovation in both material science and process engineering.

Manufacturing scalability and yield also present substantial barriers. The transition from laboratory-scale prototypes to high-volume production requires precise control over deposition, patterning, and integration of functional layers on non-planar or irregular surfaces. Variability in substrate properties and the complexity of roll-to-roll or additive manufacturing processes can lead to defects, reduced yields, and increased costs. Ensuring consistent quality and reliability across large-area, conformal devices remains a key hurdle for manufacturers such as Linxens and PARC, a Xerox Company.

Another risk involves the long-term durability and environmental stability of flexible electronics. Exposure to moisture, temperature fluctuations, and mechanical fatigue can degrade device performance over time. Encapsulation and barrier technologies are under active development, but achieving robust protection without compromising flexibility is an ongoing challenge for industry leaders like DuPont and Kuraray Co., Ltd..

From a regulatory and standardization perspective, the lack of universally accepted testing protocols and performance benchmarks complicates product qualification and market entry. Organizations such as the IEEE and SEMI are working to establish guidelines, but the rapidly evolving nature of the technology makes consensus difficult.

Finally, economic and supply chain risks must be considered. The high initial investment in specialized equipment and materials, coupled with uncertain demand forecasts, can deter potential entrants. Additionally, the reliance on novel materials or proprietary processes may create vulnerabilities in sourcing and intellectual property protection. Overcoming these barriers will require coordinated efforts across the value chain, from material suppliers to end-product manufacturers.

Future Outlook: Disruptive Innovations and Market Opportunities to 2030

The future of conformal flexible electronics manufacturing is poised for significant transformation by 2030, driven by disruptive innovations and expanding market opportunities. As industries increasingly demand electronics that can seamlessly integrate with complex surfaces and dynamic environments, manufacturers are investing in advanced materials, novel fabrication techniques, and scalable production processes. Key innovations include the development of ultra-thin, stretchable substrates and conductive inks that maintain performance under mechanical stress, enabling new applications in wearables, healthcare, automotive, and aerospace sectors.

Emerging additive manufacturing methods, such as inkjet and aerosol jet printing, are enabling high-resolution patterning of electronic circuits on flexible and irregular surfaces. These techniques reduce material waste and support rapid prototyping, accelerating the transition from concept to commercialization. Companies like DuPont and Henkel AG & Co. KGaA are at the forefront, developing advanced conductive materials and adhesives tailored for flexible and conformal electronics.

The integration of flexible electronics with the Internet of Things (IoT) is expected to unlock new market opportunities. Smart textiles, conformal sensors for health monitoring, and flexible displays are anticipated to see robust growth, supported by collaborations between electronics manufacturers and end-user industries. For instance, Samsung Electronics Co., Ltd. and LG Electronics Inc. are investing in flexible display technologies, while automotive suppliers like Continental AG are exploring conformal electronics for next-generation vehicle interiors.

Sustainability is also shaping the future outlook, with a focus on eco-friendly materials and energy-efficient manufacturing processes. Industry initiatives, such as those led by SEMI, are promoting standards and best practices to minimize environmental impact and enhance recyclability of flexible electronic components.

By 2030, the convergence of material science breakthroughs, digital manufacturing, and cross-industry partnerships is expected to drive the mainstream adoption of conformal flexible electronics. This will not only create new revenue streams for manufacturers but also enable innovative products that redefine user experiences across multiple sectors.

Sources & References

- DuPont

- Konica Minolta, Inc.

- Robert Bosch GmbH

- LG Electronics Inc.

- Institute of Electrical and Electronics Engineers (IEEE)

- imec

- FlexEnable Limited

- Apple Inc.

- Medtronic plc

- Koninklijke Philips N.V.

- Toyota Motor Corporation

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- LG Display Co., Ltd.

- Samsung Display Co., Ltd.

- Palo Alto Research Center Incorporated (PARC)

- Kuraray Co., Ltd.

- Kateeva

- NovaCentrix

- Siemens AG

- ISO/IEC 62341

- European Union Medical Device Regulation (MDR)

- Linxens

- Henkel AG & Co. KGaA